Bitcoin has had a very positive movement since the beginning of the year. Starting the year near $16,550 levels, Bitcoin went to almost double its value and almost reach $32,000 by July 2023.

Currently, the prices are somewhat stagnant near the $30,000 level. Let us explore Bitcoin’s journey since the beginning of the year with technical analysis and on-chain data.

We will also explore what experts have said about year-end price targets.

2023 Price Movement Decoded

Bitcoin started the year with a little pessimism when the markets were at $16,500 levels. This was a little better than the year’s low prices of $15,600

Yet the markets were almost stagnant. There was no positive news and a severe crackdown by government authorities pointed towards a dark future.

However, things began to turn positive by the second week of January when Bitcoin started its journey towards $23,500 – $24,000 that it reached within two weeks.

This price movement was mainly due to a technical situation, called the Bollinger Band Squeeze. This situation is characterized by a low volatility market, which was already present, followed by an increasing number of short sellers in Bitcoin Futures and Options.

It is called a Bollinger Band Squeeze because both the upper line and the lower line of the Bollinger Band come very close to each other. Both these bands show the maximum and minimum movement possibilities for Bitcoin at any given instant.

A Bollinger Squeeze always gives rise to a rapid price movement. In this scenario the movement was towards the $23,000-$24,000 zone.

This positive movement caused a period of accumulation along with Ripple’s historic win.You can see accumulation from the increased trading volumes in the above technical chart and realized market cap chart below.

A similar accumulation trend was also witnessed on Ethereum.

This accumulation might have prompted institutional investors to join the rally.

Institutional Investors Join Bitcoin Bandwagon

Cathie Wood, CEO of Ark Invest, was the first to respond by filing a Bitcoin ETF application despite rejections twice earlier.

MicroStrategy, which was led by Michael Saylor, also accumulated Bitcoin pushing its holdings to $4.17 Billion by the first week of April 2023.

In June 2023, BlackRock (managing over $9 Trillion in assets) filed the historic application which prompted institutions like Invesco, WisdomTree, Fidelity, and several others to file for Bitcoin ETF applications in the USA.

By July 2023, Bitcoin had already reached $30,000 after making a year high of $31,800 in mid july.

On-Chain Data

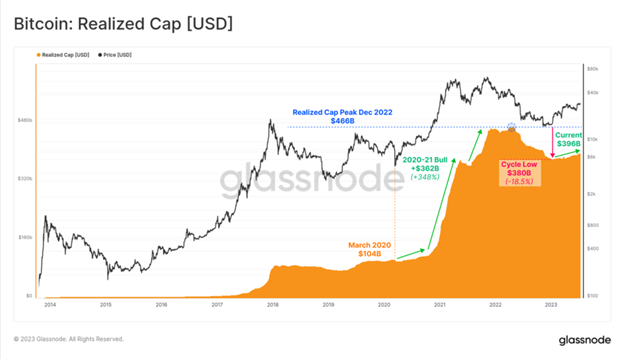

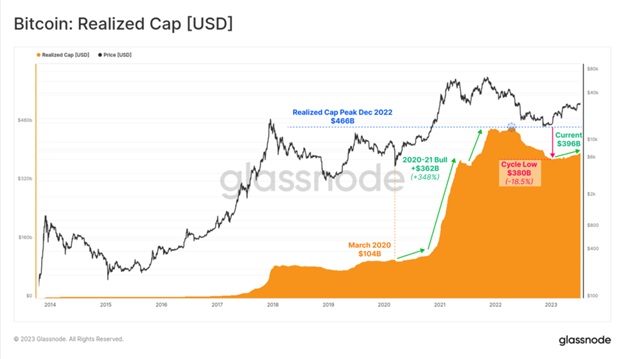

Increasing flow of money into Bitcoin is visible on-chain data too. There has been a gradual increase in realized market cap since the last couple of months.

Realized Market Cap or Net Realized Capital is the total sum of profits and losses made by all the buyers and sellers since the birth of Bitcoin.

A steady flow of funds into Bitcoin would help counter any bearishness in the markets and prop-up the prices. Further, institutional buying would definitely introduce large positive price movements.

Experts Opinion

Now that Bitcoin markets have turned bullish and positive in sentiment with the inflow of institutional investment, there has been a positive outlook for the year-end price targets.

Marshall Beard, CSO of Gemini exchange, and predicts that Bitcoin might break all-time highs of $69,000 by the end of 2023.

Paul Ardoino, CTO of Tether, also has an optimistic view of prices re-testing $69,000 by the end of 2023.

Standard Chartered bank even quotes a quadruple increase in prices by end of 2024, marking Bitcoin price at $125k.

#NOTE: All of the quotes have been sourced from Forbes Magazine.